Drive your Digital Business - from investments to results

Connect IT portfolios, enterprise architecture, and business goals in one AI-powered cloud platform - prove every dollar drives outcomes, and reallocate resources fast when priorities shift.

Drive your Digital Business - from investments to results

Connect IT portfolios, enterprise architecture, and business goals in one AI-powered cloud platform - prove every dollar drives outcomes, and reallocate resources fast when priorities shift.

When priorities change overnight (e.g., "pivot to Generative AI now"), you can't re-plan fast enough because data is stale.

Gartner predicts 70% of CIOs will shift from cost optimization to driving business transformation by 2027.

Planisware helps with portfolio prioritization and scenario planning to shift away from cost center approach.

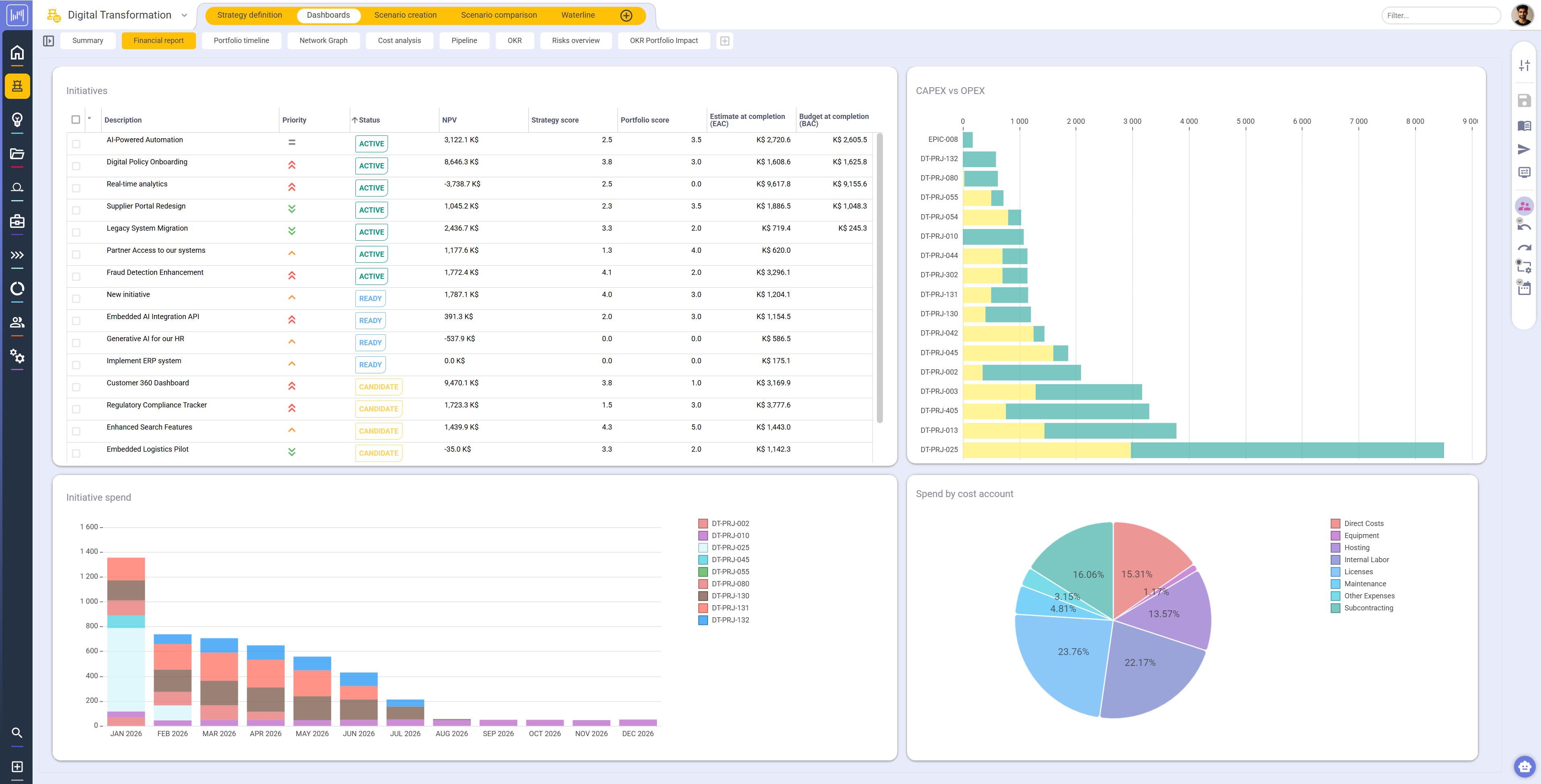

Value of investments and the cost of your digital products are hard to measure because labor, licenses, and infrastructure costs are scattered across disparate systems

More than 50% of IT budgets are consumed by legacy assets, slowing down innovation.

Planisware helps releases budget locked in outdated assets and accelerates modernization with TCO tracking.

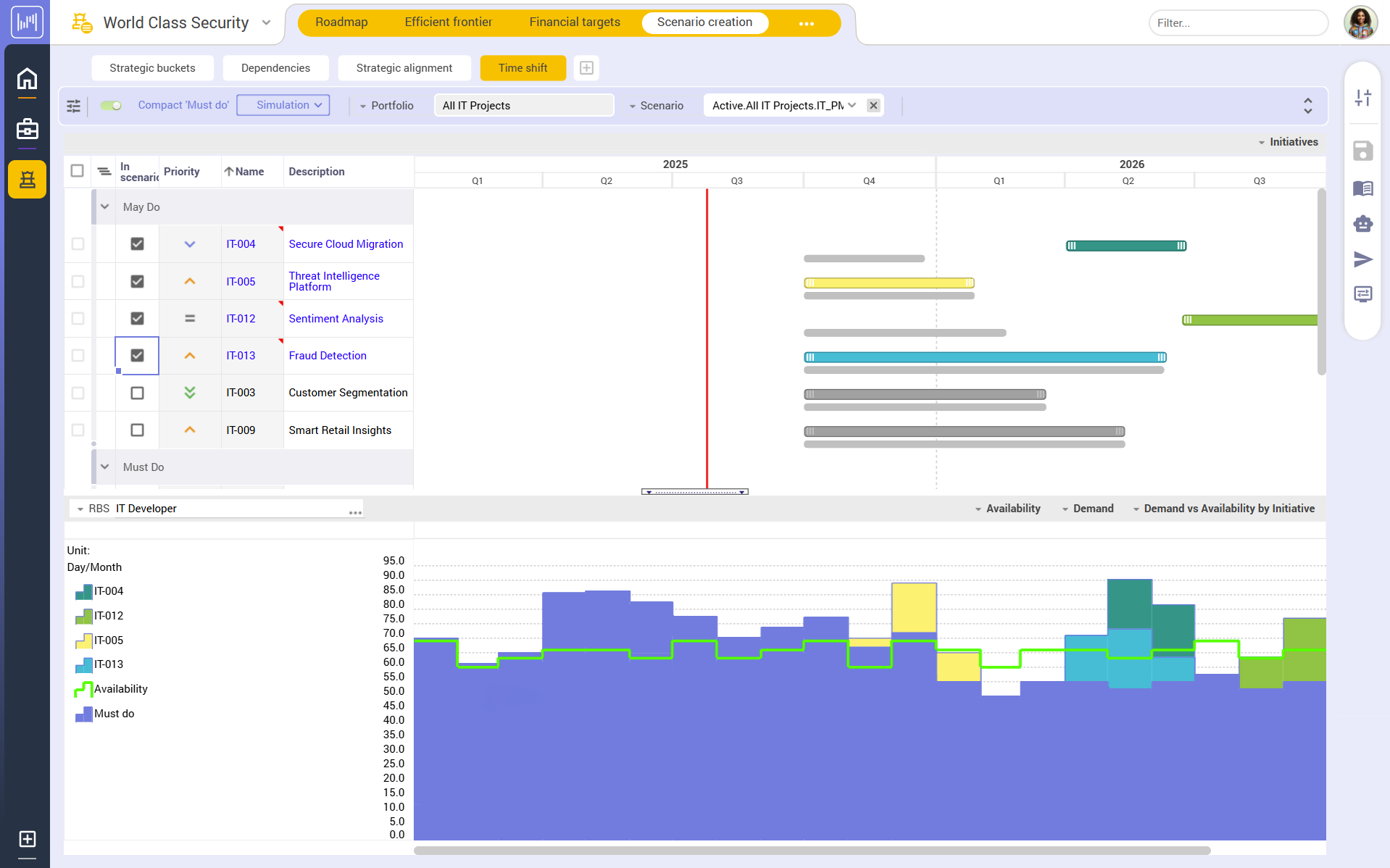

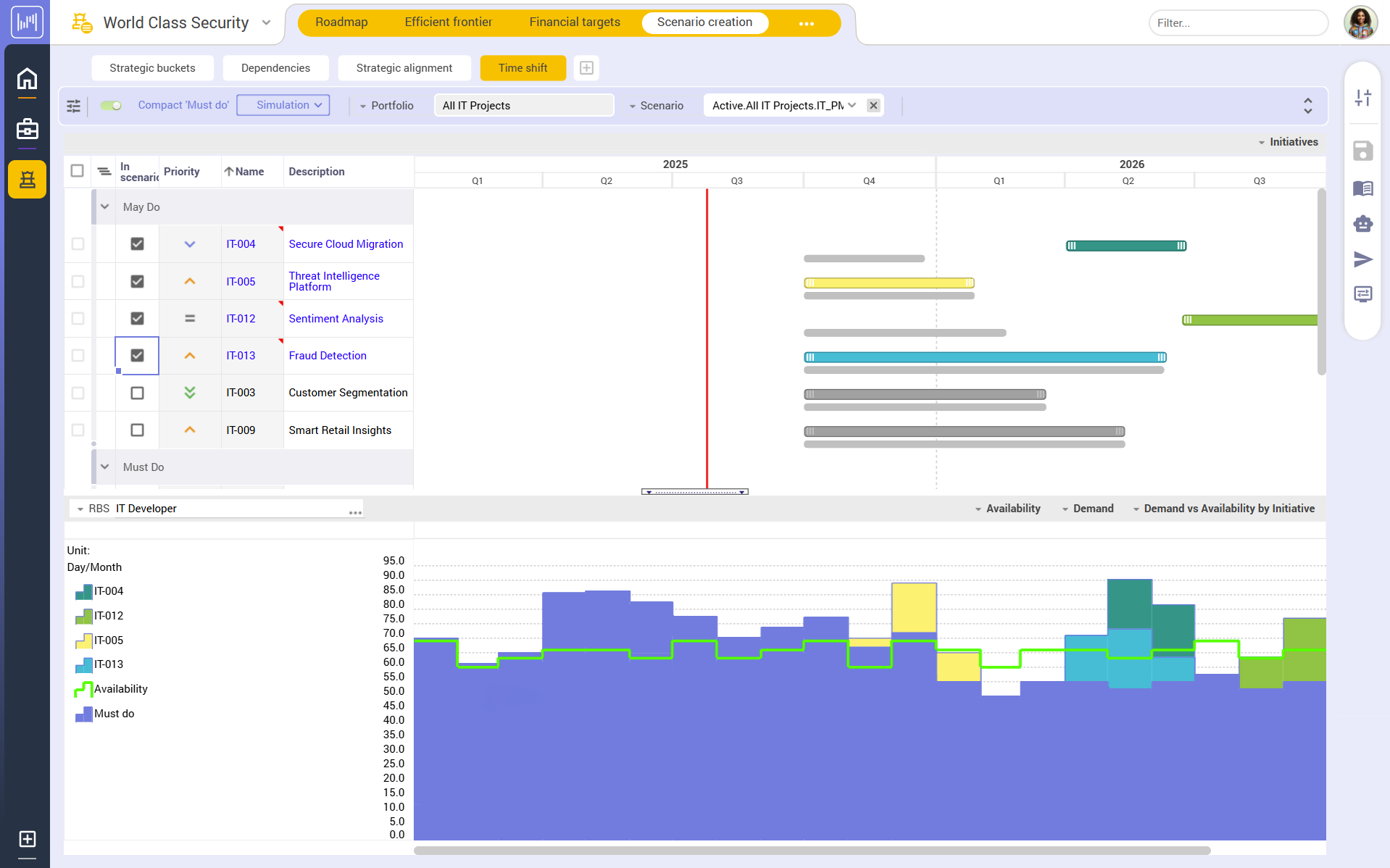

You commit to roadmaps without knowing if shared resources (Security Architects, Database Administrators, UX Designers) are already overbooked and if they are working on the right projects.

Organizations waste up to 30% of IT spend on misaligned projects due to poor portfolio visibility.

Planisware helps gain end-to-end portfolio visibility, eliminates misaligned projects and ensures every investment create value.

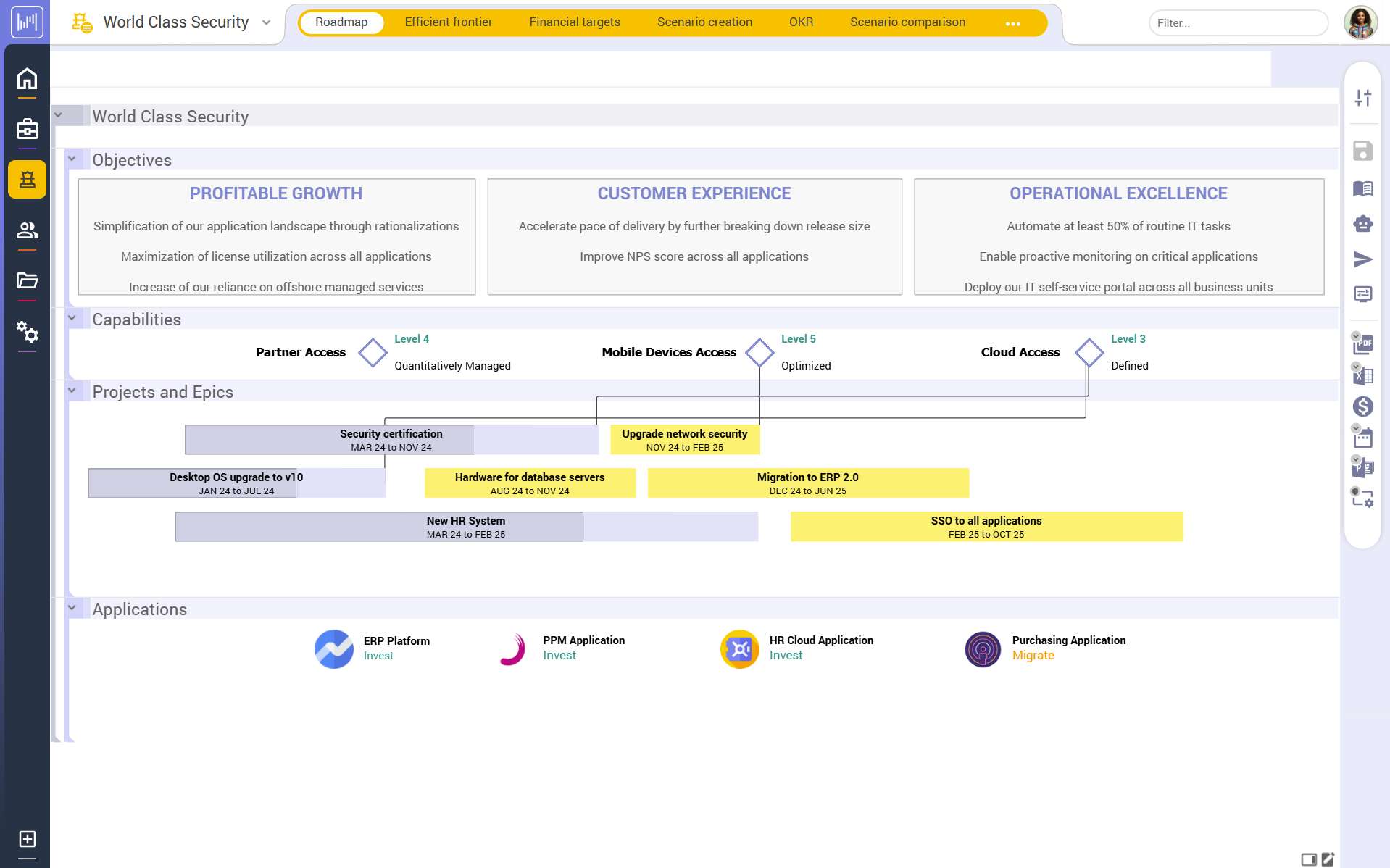

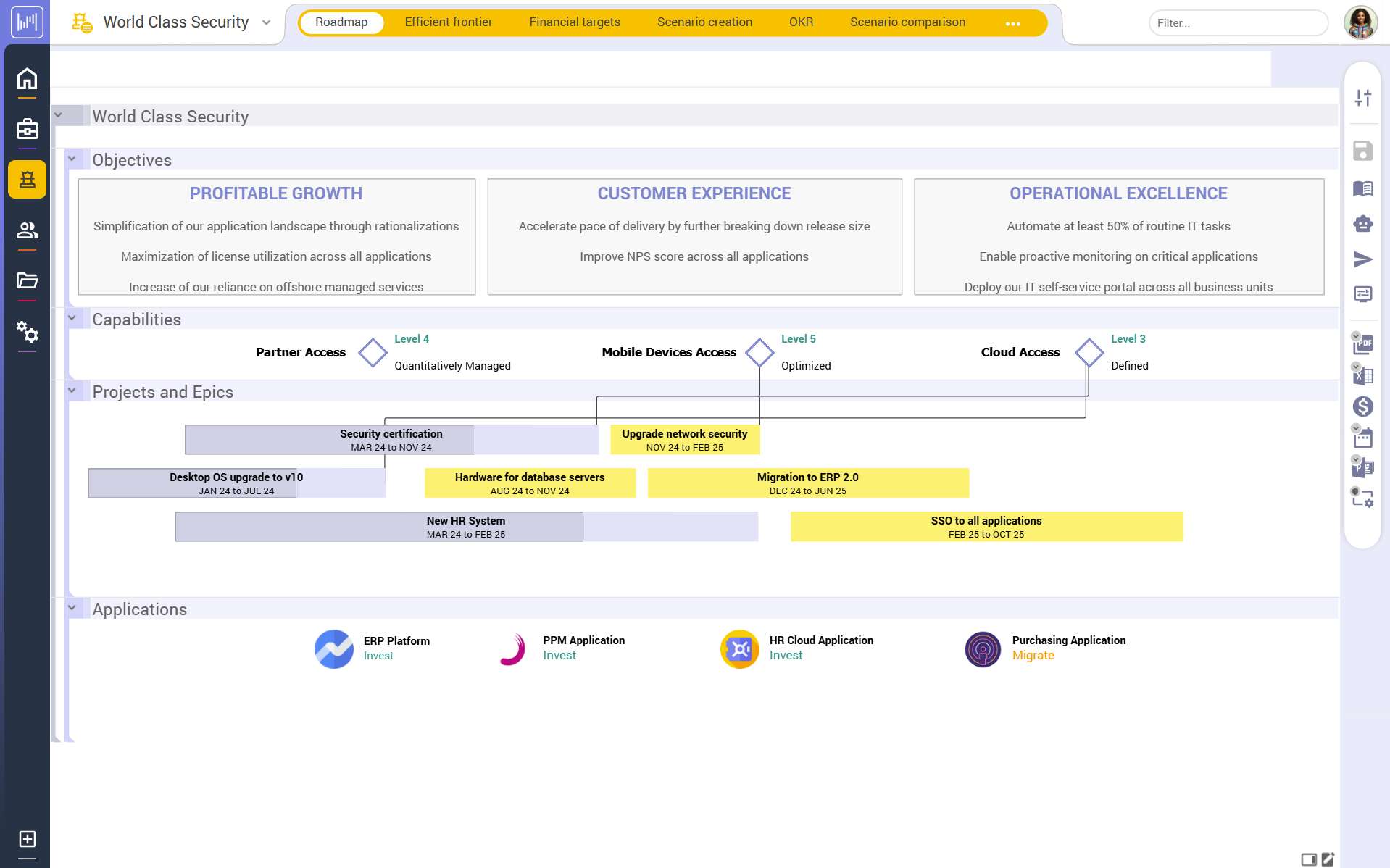

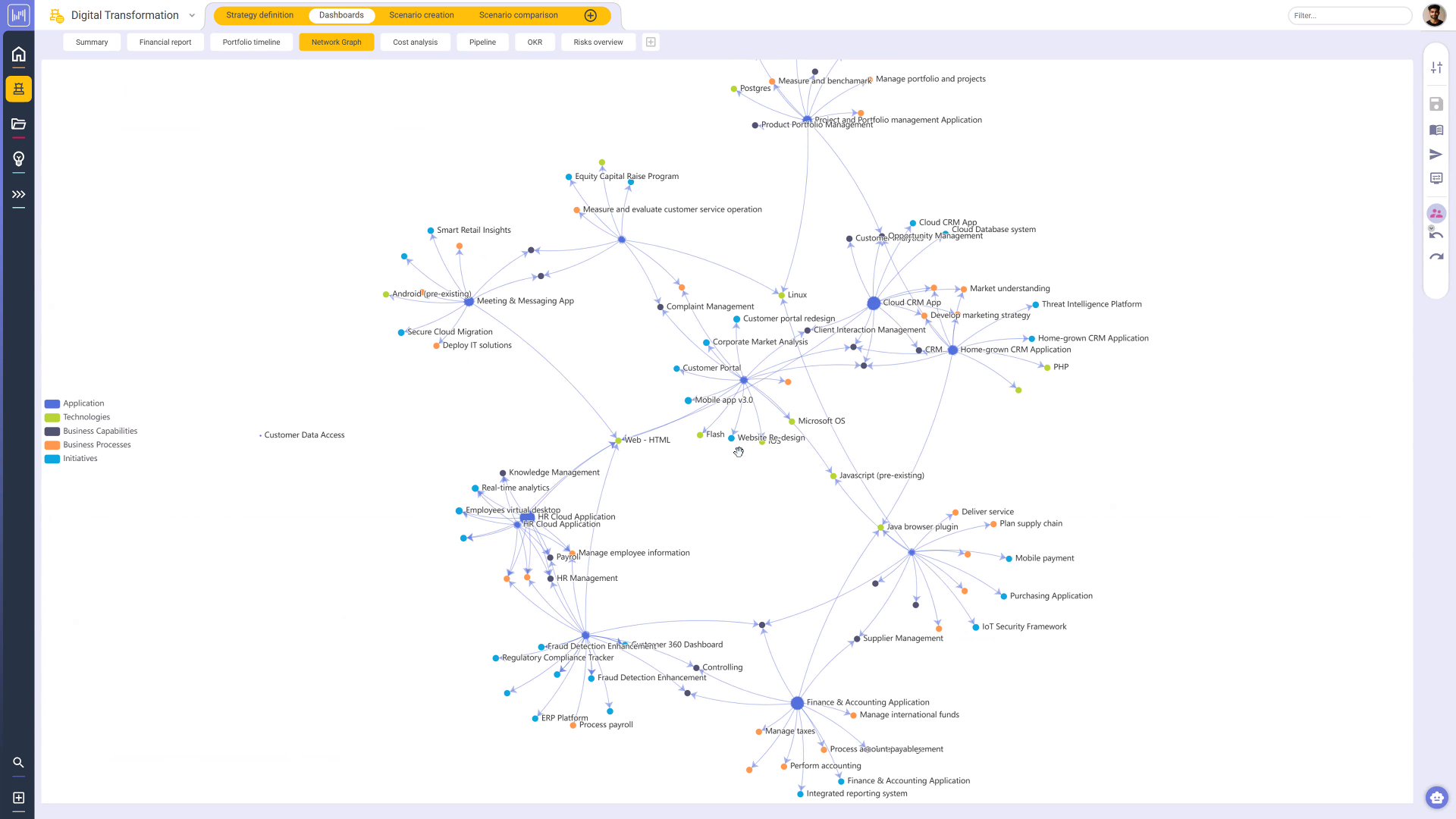

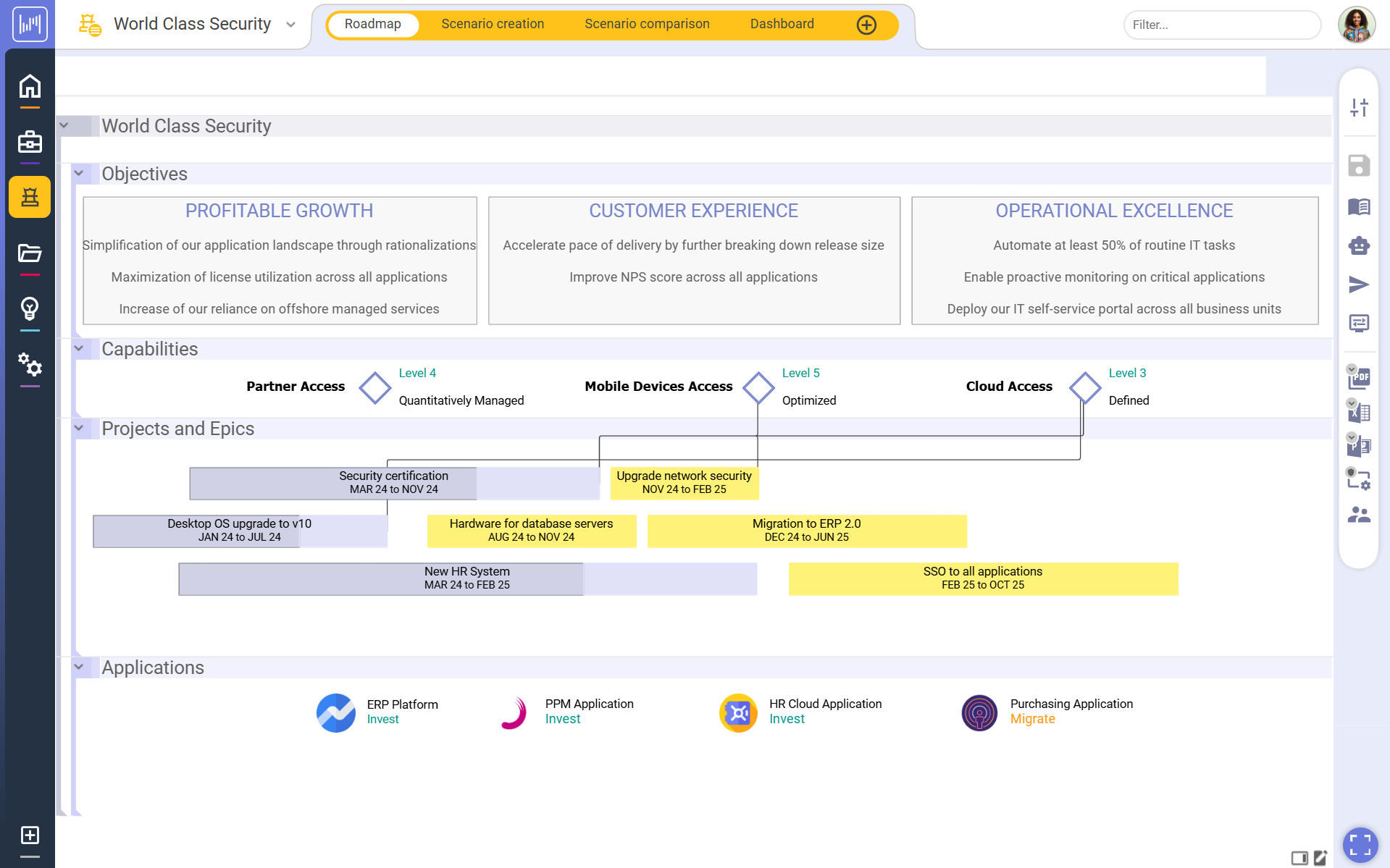

Track your strategy with roadmaps and OKRs. Use dynamic what-if scenarios to instantly model budget cuts, strategic pivots, or new priorities without disrupting ongoing delivery.

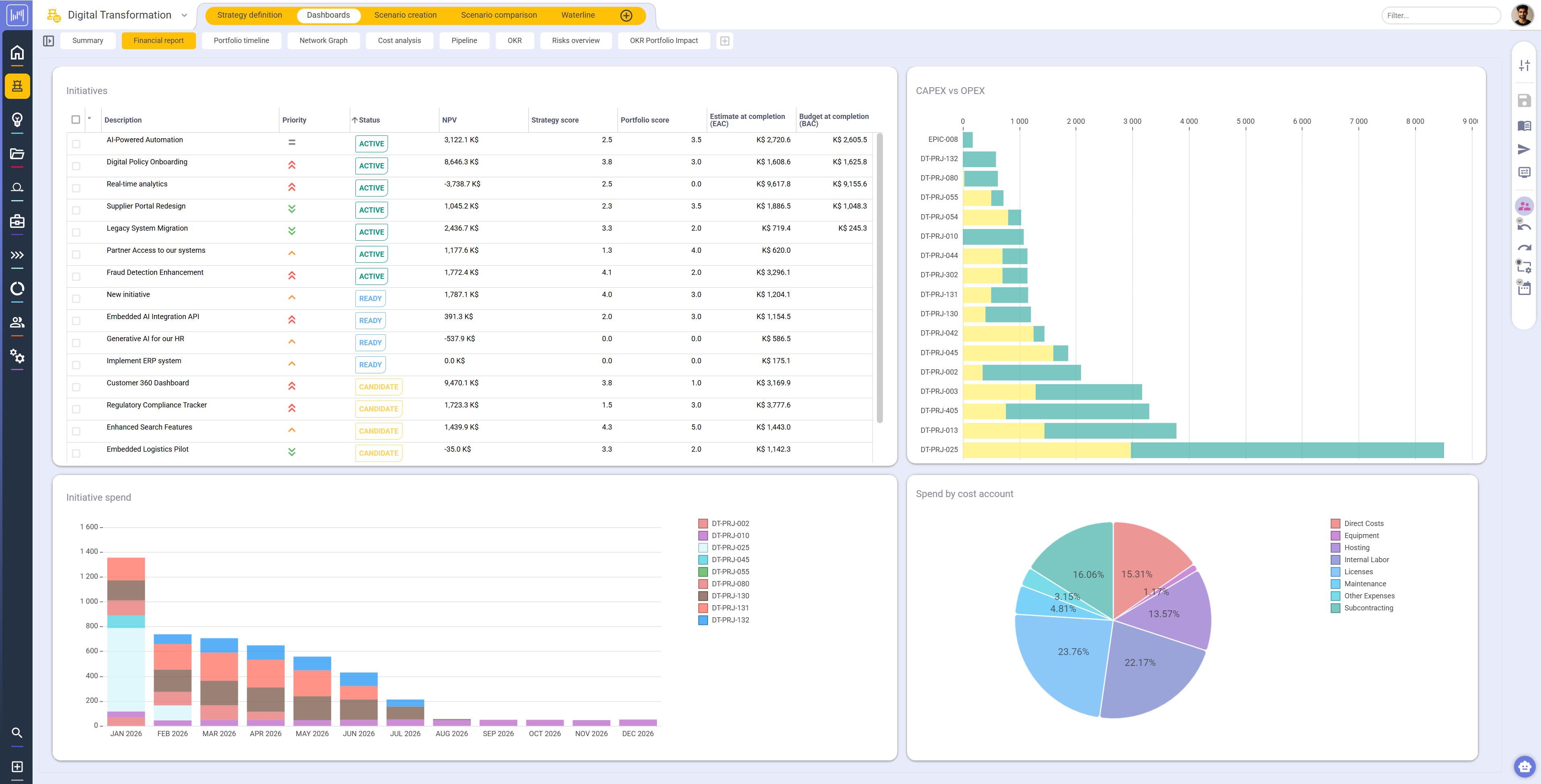

Accelerate your financial planning cycles and gain audit-ready confidence in the cost, value, and ROI of your digital portfolio.

Manage your critical resources and skills across your entire portfolio - from annual capacity planning down to time tracking and actuals.

The myth of the "pure agile" enterprise doesn't match reality. Large IT organizations are inherently hybrid: Waterfall for infrastructure (Stage-Gate governance), Scrum for application teams, and SAFe for cross-team coordination. Planisware manages them all in a single place.

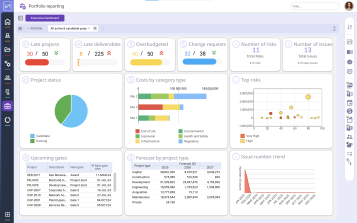

![[Enterprise][25Q3] Portfolio Comparison Dashbaord](/sites/default/files/2026-02/Enterprise%2025Q3%20Portfolio%20Comparison%20Dashbaord.png)

![[Enterprise][25Q3] Portfolio Comparison Dashbaord](/sites/default/files/2026-02/Enterprise%2025Q3%20Portfolio%20Comparison%20Dashbaord.png)

Synchronize investments, resources, and roadmaps with business value.

The trusted view of IT investments. Audit-ready. ROI-proven. Value-tracked.

End ambiguity. Know your resources, your constraints, and your options.

Stay aligned with strategy while your team stays agile. No methodology wars.

Reduce technical debt while funding innovation. Connect IT strategy to business outcomes.

Manage progressive IT transition to future state; integrate business capabilities, applications, IT services, digital products with investments.

Integrated IT Portfolio Analysis turns IT from an opaque cost center into a transparent value engine.

By mapping applications, projects, and services to business capabilities and outcomes, IIPA gives CIOs a single, trusted view of where money and effort truly create impact.

This clarity enables smarter investment choices, targeted technical-debt reduction, and data-driven conversations with the business: transforming IT from a perceived black box into a strategic lever for digital growth and innovation.

Modern IT organizations are moving from project silos to digital products and value streams that mirror how they create business value. Instead of funding one-off initiatives, they fund persistent product teams that own end‑to‑end customer outcomes: onboarding, payments, claims, or channels.

Planisware Horizon helps you structure portfolios around these value streams, connect strategy to product roadmaps, and continuously rebalance investment as priorities shift. This model shortens time‑to‑value, improves flow from idea to production, and lets IT operate as a true business partner, not a cost center.

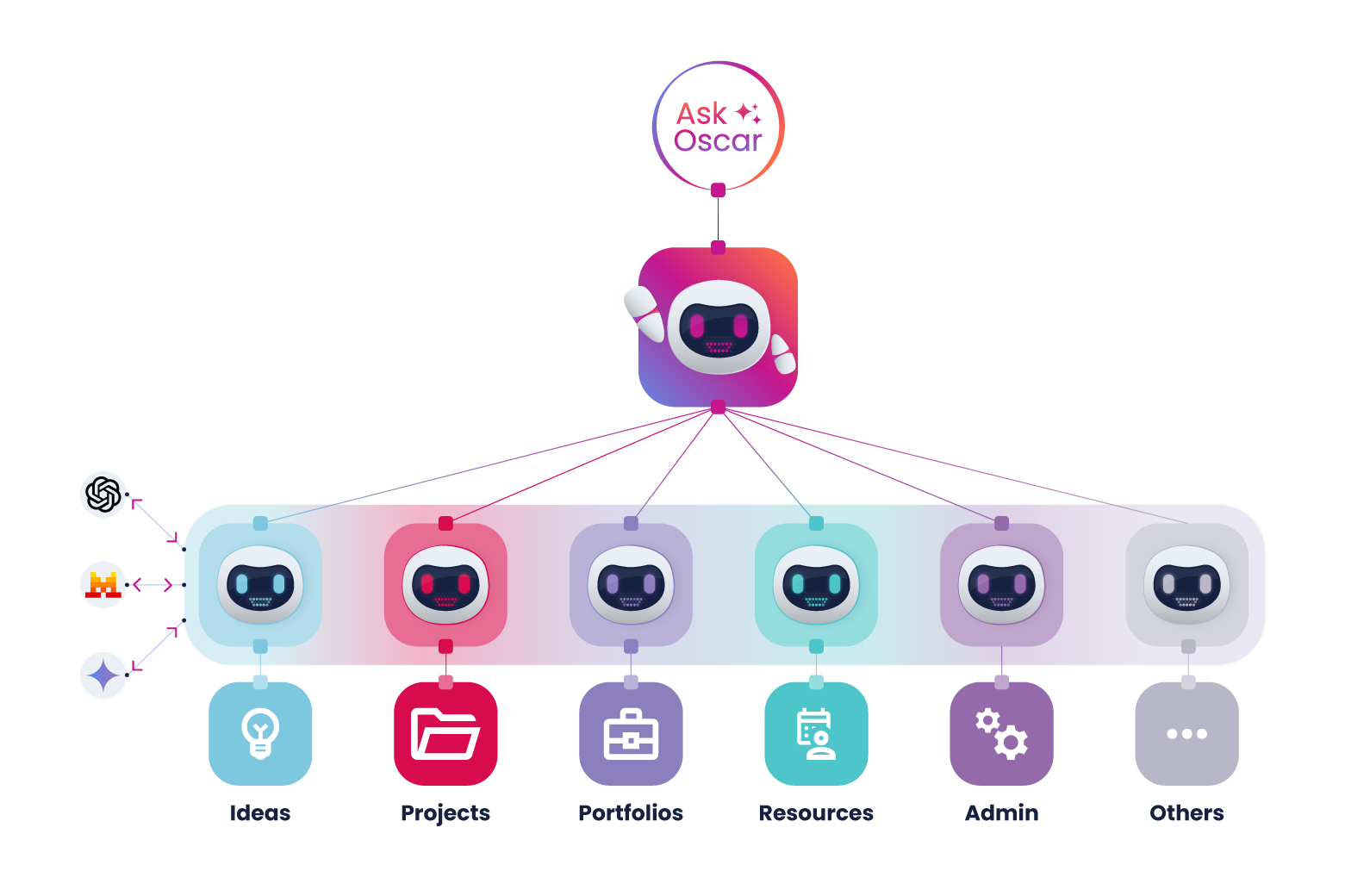

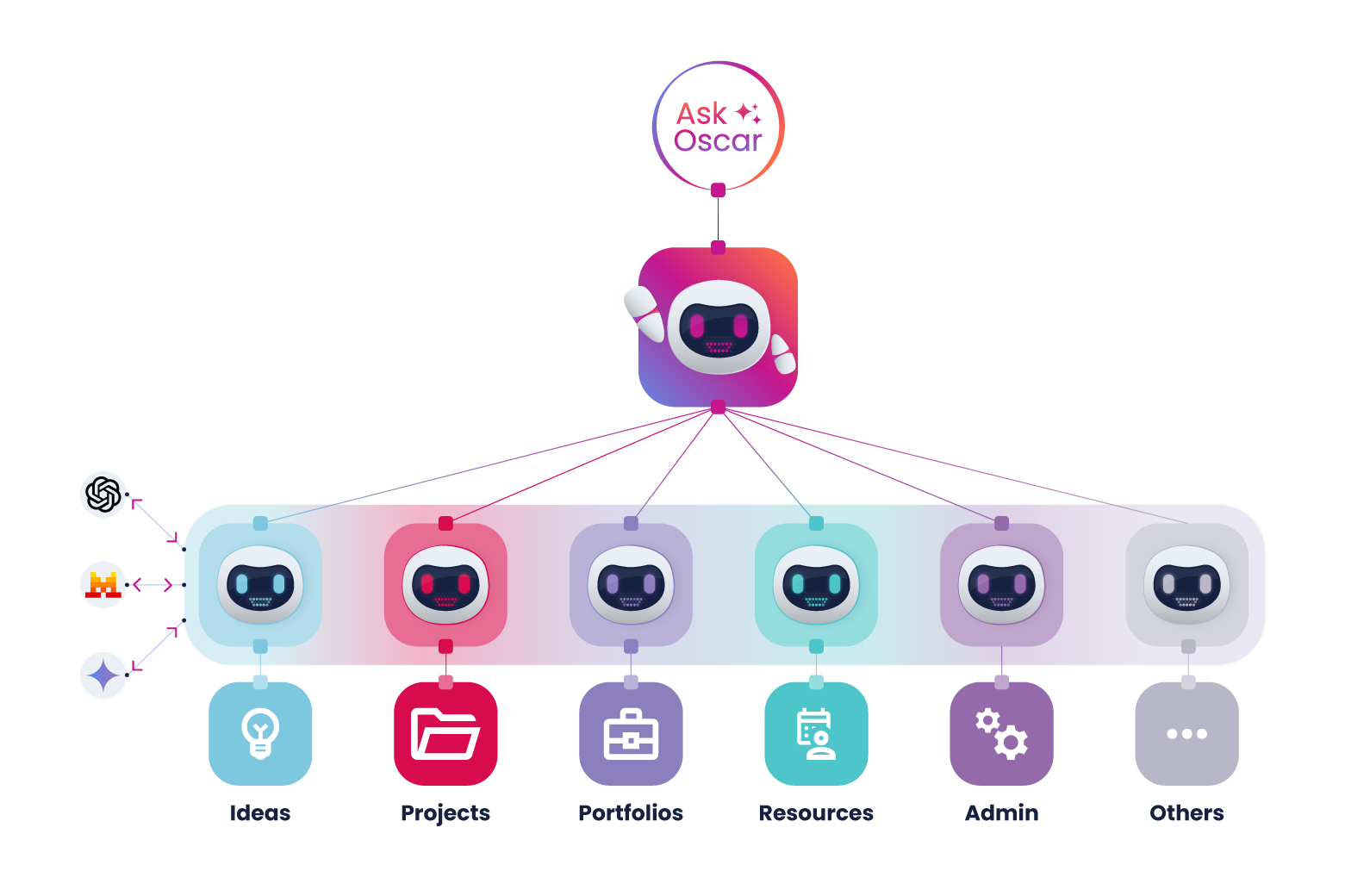

Planisware AI agents offer personalized, context-aware guidance, automate reporting and scheduling, perform tasks, execute workflows, answer user questions, and validate project data.

Build confidence and robustness in your planning by leveraging AI predictive modeling to assess outcomes, timing, or risks.

![[Enterprise][25Q3] AI Risk Generation](/sites/default/files/2025-10/%5BEnterprise%5D%5B25Q3%5D%20AI%20Risk%20Generation.gif)

Transform how your teams interact with project data through the power of conversation. Accelerate onboarding and ensure robust adoption.

![[Enterprise][25Q1] AI Help Assistive](/sites/default/files/2025-10/%5BEnterprise%5D%5B25Q1%5D%20AI%20Help%20Assistive.gif)

![[Enterprise][25Q3] AI Risk Generation](/sites/default/files/2025-10/%5BEnterprise%5D%5B25Q3%5D%20AI%20Risk%20Generation.gif)

![[Enterprise][25Q1] AI Help Assistive](/sites/default/files/2025-10/%5BEnterprise%5D%5B25Q1%5D%20AI%20Help%20Assistive.gif)

To make optimal decisions, combine various information from your application ecosystem directly within your solution. For instance, integrating data coming from your ERPs, accounting systems, agile tools, ITSM, and other third-party sources.

Planisware provides dozens of native connectors as well as a robust REST API framework to integrate data seamlessly.

Planisware aligns with the COBIT framework (Control Objectives for Information and Related Technologies), ensuring that our platform supports effective IT governance and risk management practices. This alignment empowers organizations to achieve strategic goals while maintaining compliance and optimizing IT resources.

Planisware integrates seamlessly with ITIL principles (Information Technology Infrastructure Library), enabling organizations to enhance IT service management, improve service delivery, and align IT processes with business objectives. By adhering to ITIL best practices, Planisware helps IT teams optimize resource utilization, reduce service disruptions, and drive continuous improvement in IT operations.

Planisware aligns with ISO 38500 standards, providing a robust platform that supports the principles of effective IT governance. By following these guidelines, Planisware enables organizations to ensure that their IT investments are strategically aligned, risk-managed, and delivering maximum value to the business.

Planisware supports CMMI principles (Capability Maturity Model Integration) by offering a platform that drives process maturity and continuous improvement. This alignment enables organizations to optimize project management, enhance process efficiency, and achieve higher levels of performance and quality in their IT and business operations.

Planisware integrates with TOGAF (The Open Group Architecture Framework), enabling organizations to effectively design and manage their enterprise architecture. By leveraging TOGAF's structured approach, Planisware helps businesses align their IT strategy with business objectives, optimize resource utilization, and ensure that technology investments support long-term goals.

Planisware offers an extensive library of thought leadership, implementation guides, and practical tools to help organizations advance their strategic portfolio management capabilities. The following resources provide deep dives into specific dimensions of SPM—from foundational concepts through advanced AI-powered optimization—enabling leaders to build expertise progressively and address their unique organizational challenges.

These resources collectively provide the knowledge foundation needed to advance from portfolio management fundamentals through enterprise-scale strategic transformation. Organizations at different maturity stages—whether establishing initial governance structures, optimizing existing portfolios, or implementing AI-powered decision support—will find targeted guidance addressing their specific priorities. For personalized recommendations based on your organization's current state and strategic objectives, explore Planisware's strategic portfolio management solutions or schedule a consultation with SPM experts.

Strategic Portfolio Management (SPM) is a comprehensive set of business processes, capabilities, and technology that enables organizations to align finite resources with enterprise-wide strategic goals. Unlike traditional project management, which focuses on delivering individual projects on time and within budget, SPM operates as a top-down framework that connects every investment decision—whether projects, products, or services—to measurable business outcomes and long-term competitive positioning.

The distinction becomes clearer when examining scope and decision-making authority:

| Approach | Focus | Decision Drivers | Visibility Level |

|---|---|---|---|

| Project Management | Individual project execution and delivery | Timeline, budget, scope adherence | Project-level metrics |

| Project Portfolio Management (PPM) | Managing multiple projects within portfolios | Resource optimization, risk management | Portfolio-level performance |

| Strategic Portfolio Management (SPM) | Enterprise-wide strategy-to-execution alignment | Value creation, strategic impact, competitive advantage | Organizational outcomes |

The business case for SPM is compelling: organizations using SPM tools achieve 30% better delivery performance and experience a 60% reduction in project failure rates compared to those relying on traditional approaches. Consider that only 0.5% of IT projects meet all three success criteria—delivered on time, within budget, and delivering intended benefits. This execution gap exists primarily because strategy and execution operate in silos. SPM bridges this divide by providing real-time visibility into how operational activities connect to strategic objectives.

Industry leaders like Ford and Bristol-Myers Squibb demonstrate SPM's transformative impact. Ford consolidated fragmented tech and project innovation data into a single source of truth, enabling real-time portfolio adjustments. BMS implemented a PMO Center of Excellence that elevated data accuracy to 98%, providing leadership teams with unprecedented confidence in portfolio decision-making.

For organizations navigating digital transformation, SPM shifts the fundamental question from "Are we executing projects efficiently?" to "Are we investing in the right initiatives that deliver sustainable competitive advantage?" This strategic lens becomes critical when 59% of executives and 60% of CIOs are actively investing in new technology, yet many struggle to demonstrate measurable business value from these investments.

Learn more about how Planisware's strategic portfolio management solutions help organizations translate vision into measurable impact, or explore IT governance and digital transformation strategies that align technology investments with business priorities.

Strategic Portfolio Management delivers measurable value across six critical dimensions that directly impact organizational performance and competitive positioning. Organizations that successfully implement SPM see tangible improvements in strategic execution, resource efficiency, and business agility—translating into superior financial outcomes and market responsiveness.

| Benefit Category | Key Metrics | Business Impact |

|---|---|---|

| Strategic Alignment | 80% of project managers cite PPM as critical to business success | Every initiative contributes meaningfully to long-term objectives; eliminates misaligned "vanity projects" |

| Resource Optimization | 30% improvement in delivery performance | Maximizes asset utilization while minimizing waste and conflicts across concurrent initiatives |

| Risk Mitigation | 60% reduction in project failure rates | Comprehensive portfolio visibility enables proactive risk identification and dependency management |

| Decision Velocity | 5x faster, smarter decisions with data-driven approaches | Real-time analytics support confident pivots and rapid resource reallocation |

| Financial Returns | ROI of 1,301% ($13.01 per dollar spent) on data analytics solutions | Better project selection and execution optimize capital deployment |

| Stakeholder Confidence | 90% of data-driven organizations meet or exceed revenue goals | Transparent dashboards and automated reporting strengthen trust across organizational levels |

The strategic alignment benefit addresses a critical pain point: 37% of project failures stem from lack of clear goals. SPM creates a "golden thread" connecting C-suite vision to operational execution, ensuring every team understands how their work advances enterprise objectives. This alignment becomes particularly valuable when market conditions shift—organizations with adaptive SPM frameworks can reprioritize portfolios in weeks rather than waiting for annual planning cycles.

Resource optimization extends beyond simply allocating people to projects. Leading organizations leverage SPM to eliminate redundancies, identify synergies between initiatives, and maintain optimal capacity utilization. When properly implemented, SPM provides the intelligence needed to answer critical questions: Which projects should we kill to free resources for higher-value opportunities? Where are resource bottlenecks creating portfolio-wide delays? How do we balance innovation investments against operational improvements?

BMS's experience illustrates the confidence dimension: after implementing enterprise-level portfolio management, the organization achieved 98% data accuracy, enabling leadership to make portfolio decisions backed by reliable intelligence rather than speculation. This data integrity transformed stakeholder engagement, as executives could confidently justify resource allocation and investment priorities to boards and investors.

The financial returns merit particular attention. Companies operating with real-time portfolio intelligence demonstrate 62% higher revenue growth and 97% higher profit margins compared to competitors using batch processing and static planning. These performance gaps reflect SPM's ability to accelerate time-to-value, identify underperforming investments early, and redirect capital toward higher-impact opportunities.

Discover how Planisware's demand management capabilities streamline idea collection and prioritization, or learn about proven benefits of strategic portfolio management across enterprise environments.

Organizations embarking on SPM implementation encounter five recurring challenges that can derail initiatives or significantly limit value realization. Understanding these obstacles—and proven mitigation strategies—is essential for C-suite leaders sponsoring portfolio transformation programs.

| Challenge | Prevalence/Impact | Root Causes |

|---|---|---|

| Measuring ROI and Value Realization | 25% of companies unable to measure SPM technology ROI | Undefined success metrics; lack of baseline data; benefits realized post-implementation without tracking mechanisms |

| Strategic Alignment Gaps | 51% of tech executives see no performance increase from digital investments | Unclear or frequently changing strategic goals; poor communication; misalignment between portfolio composition and stated objectives |

| Resource Balancing | 85% of project managers work on multiple concurrent projects | Competing demands from different portfolios; limited visibility into capacity; specialized resource constraints |

| Change Management and Adoption | Top management commitment cited as #1 success factor | Resistance from established power structures; inadequate executive sponsorship; insufficient training and communication |

| Data Quality and Integration | Significant barrier to decision-making effectiveness | Fragmented systems; inconsistent processes across business units; manual data collection introducing errors and delays |

The ROI measurement challenge deserves particular scrutiny. Unlike traditional IT implementations with clear cost-benefit calculations, SPM delivers value through improved decision quality, accelerated time-to-market, and avoided opportunity costs—benefits that manifest over extended timeframes and require disciplined tracking. Organizations must establish baseline measurements before implementation (current project success rates, resource utilization, strategic alignment scores) and define specific KPIs tied to business outcomes rather than activity metrics.

Strategic alignment gaps often stem from a fundamental misunderstanding: SPM is not a software implementation but an operating model transformation. When executives view portfolio management as a PMO tool rather than a C-suite strategic discipline, the initiative becomes tactical rather than transformational. Successful implementations begin with executive alignment workshops where leadership teams articulate strategic themes, define investment guardrails, and commit to governance processes that enforce prioritization discipline.

The change management dimension extends beyond training. Research indicates that 60% of companies have not implemented formal project management methodologies, meaning SPM introduces entirely new ways of working. Organizations must address cultural resistance to portfolio transparency—some business units may resist unified governance because it exposes underperforming initiatives or questions long-standing investment patterns.

Proven Mitigation Strategies:

Establish executive-led governance from day one, with C-suite sponsors actively participating in portfolio reviews and modeling prioritization discipline. Create a phased implementation approach that delivers quick wins within 12-18 months while building toward comprehensive capabilities over 2-3 years. Invest in data infrastructure and process standardization before deploying SPM technology—tools amplify existing processes, so flawed foundations produce flawed outcomes at scale. Designate portfolio champions within each business unit to provide peer support and accelerate adoption. Finally, tie SPM success metrics to executive compensation and strategic planning processes, signaling that portfolio discipline is a core organizational competency rather than an optional initiative.

Ford's digital transformation journey exemplifies effective challenge mitigation. The organization confronted data fragmentation by consolidating multiple project tracking systems into a unified platform, enabling real-time portfolio visibility. This infrastructure investment preceded process changes and technology deployment, ensuring the SPM platform had reliable data from launch.

Explore best practices for selecting and implementing PPM tools, or learn about the 100X PMO framework for driving breakthrough business impact with AI-enabled strategic portfolio management.

Measuring SPM effectiveness requires a multidimensional framework that captures both leading indicators (predictive metrics signaling future performance) and lagging indicators (outcome metrics demonstrating realized value). Organizations that excel at value realization establish measurement systems before implementation, enabling baseline comparisons that quantify SPM's business impact.

| Metric Category | Example Metrics | Measurement Purpose |

|---|---|---|

| Strategic Alignment | % of portfolio resources allocated to strategic themes; strategic initiative completion rate; alignment score across business units | Validates that investment decisions reflect stated priorities rather than organizational inertia |

| Portfolio Performance | On-time delivery rate (target: 70%+); on-budget completion (target: 70%+); benefits realization rate (target: 65%+) | Assesses execution capability and project selection quality |

| Resource Optimization | Resource utilization rate; portfolio capacity vs. demand; time-to-staffing for critical roles | Identifies bottlenecks and ensures optimal asset deployment |

| Financial Returns | Portfolio ROI; cost avoidance from killed projects; NPV of active portfolio; revenue impact from completed initiatives | Demonstrates financial value creation and capital efficiency |

| Decision Quality | Time from idea to approval decision; scenario analyses conducted per quarter; portfolio rebalancing frequency | Measures organizational agility and evidence-based decision-making maturity |

| Risk Management | High-risk project percentage; dependency conflicts identified/resolved; portfolio risk exposure trending | Ensures balanced risk-return profile across entire portfolio |

Current industry benchmarks provide context for setting realistic targets: 38% of organizations complete projects on time, 41% finish on budget, and only 39% deliver full intended benefits. Organizations implementing mature SPM practices consistently achieve performance 15-20 percentage points above these averages. The compound effect is substantial: improving on-time delivery from 38% to 53% and benefits realization from 39% to 54% can translate to millions in accelerated revenue and avoided waste for enterprise portfolios.

Benefits realization management deserves particular emphasis, as it extends measurement responsibility beyond project closure into operational use. Many strategic benefits—cost reduction, market share gains, customer satisfaction improvements—manifest 12-24 months after implementation. Organizations must designate benefit owners (typically business leaders, not project managers) accountable for tracking outcomes and course-correcting when realization falls short. This ownership model prevents the common pattern where projects are declared "successful" at go-live despite failing to deliver business value.

Leading SPM platforms enable power metrics—advanced measurements combining multiple data sources to provide predictive insights. For example, tracking the ratio of strategic project resources to total portfolio capacity reveals whether tactical work crowds out transformational initiatives. Monitoring the cycle time from strategic decision to portfolio execution identifies governance bottlenecks that slow organizational responsiveness. These composite metrics provide executive dashboards with actionable intelligence rather than status reporting.

The measurement framework must also capture qualitative dimensions: stakeholder confidence in portfolio data (measured through surveys), cross-functional collaboration quality (assessed via collaboration patterns), and strategic learning velocity (evaluated by how quickly portfolio adjustments occur after market signals). Organizations with strong data cultures—where 90% meet or exceed revenue goals—systematically measure and improve these dimensions alongside quantitative metrics.

Implementation timing matters: establish baseline measurements 90 days before SPM deployment, conduct formal reviews at 6, 12, and 24 months post-implementation, and integrate portfolio performance metrics into quarterly business reviews. This cadence ensures leadership maintains visibility into value realization while allowing sufficient time for benefits to materialize.

Discover how Planisware's analytics and reporting capabilities provide real-time visibility into portfolio health, or explore digital portfolio management solutions that integrate strategic planning through agile delivery with comprehensive measurement.

Demand management serves as the critical front door to strategic portfolio management—the disciplined process for capturing, evaluating, and prioritizing the continuous stream of ideas, requests, and proposals competing for organizational resources. Without effective demand management, even the most sophisticated portfolio optimization tools cannot prevent strategic misalignment, resource overcommitment, and initiative overload that plague many organizations.

The business case for rigorous demand management is compelling: 37% of project failures stem from lack of clear goals, and organizations attempting to run too many concurrent initiatives consistently underperform competitors that maintain focus through disciplined intake and prioritization. Demand management addresses these risks by creating a single point of entry for all work requests, implementing consistent evaluation criteria, and establishing governance mechanisms that prevent unvetted projects from bypassing portfolio oversight.

Demand Management Process Architecture:

A mature demand management capability encompasses four interconnected components working in concert:

Centralized Intake Portal: Unified digital channel for submitting ideas, business cases, and project requests with standardized templates capturing strategic rationale, expected benefits, resource requirements, and dependencies. This consolidation replaces the fragmented approach where projects emerge from informal conversations, email requests, or political pressure—creating portfolio opacity and governance gaps.

Evaluation and Scoring Framework: Consistent criteria applied to all proposals, typically assessing strategic alignment (does this advance our top 3-5 strategic themes?), business value (quantified financial and non-financial benefits), implementation (effort, risk, dependencies), and resource availability (specialized skills, capacity constraints). Leading organizations use weighted scoring models that reflect strategic priorities—for example, allocating 40% weight to strategic alignment, 30% to business value, 20% to implementation risk, and 10% to urgency.

Governance and Decision Rights: Clear authority structure specifying who approves proposals at different investment thresholds. Typical models include three decision tiers: (1) ideas under $50K approved by functional leaders; (2) initiatives $50K-$500K approved by portfolio management committees; (3) strategic investments exceeding $500K requiring C-suite endorsement. This tiered approach balances agility with oversight, preventing executive bottlenecks on small requests while ensuring strategic visibility into major commitments.

Portfolio Integration: Seamless connection between approved demand and portfolio execution, ensuring selected initiatives receive proper resourcing, governance, and tracking. This integration prevents the common disconnect where projects are "approved" but never adequately staffed, creating phantom portfolio commitments that distort capacity planning.

The business impact extends beyond preventing bad projects—effective demand management accelerates time-to-value for high-impact initiatives by eliminating queue delays and resource conflicts. Organizations with mature demand capabilities report 20-30% reduction in time from idea submission to project kickoff for strategic initiatives, translating to earlier benefit realization and improved competitive positioning.

Demand management also provides critical portfolio intelligence. By analyzing the volume, source, and nature of incoming requests, executives gain visibility into organizational pain points (high volumes of operational improvement requests signal process inefficiencies), innovation velocity (rate of new product/service ideas), and strategic alignment gaps (requests inconsistent with stated strategy indicate communication or incentive misalignment).

Integration with capacity planning is essential. Organizations must compare incoming demand against available capacity, providing executives with realistic assessments of what can be delivered versus wishful thinking. This transparency enables difficult but necessary conversations: "We received 150 project requests totaling $50M investment and 200 FTE effort, but our capacity is $30M and 120 FTE. Here are the strategic trade-offs for consideration."

For IT organizations specifically, demand management addresses unique challenges including shadow IT (business units procuring technology outside IT oversight), technical debt (maintenance work competing with innovation investments), and platform dependencies (projects constrained by infrastructure limitations). A unified demand process brings these diverse request types into a common prioritization framework, enabling holistic portfolio optimization.

Learn how Planisware's demand management module streamlines idea collection, scoring, and transformation into early-stage projects with integrated financial planning, or explore best practices for choosing PPM tools that support enterprise demand management requirements.

Project prioritization represents one of strategic portfolio management's most consequential—and politically charged—challenges. With 85% of project managers working on multiple concurrent initiatives and most organizations facing demand exceeding capacity by 40-60%, prioritization discipline directly determines whether portfolios deliver strategic value or devolve into activity without impact. Effective prioritization requires combining analytical rigor with executive courage to make difficult trade-offs.

Proven Prioritization Framework Selection:

Organizations should select prioritization methods aligned with their strategic maturity, data availability, and decision-making culture:

| Framework | Best For | Key Characteristics | Implementation Complexity |

|---|---|---|---|

| Weighted Scoring Model | Balanced evaluation across multiple strategic dimensions | Assigns importance weights (e.g., 40% strategic fit, 30% financial return, 20% risk, 10% urgency); quantifies subjective assessments | Moderate; requires consensus on criteria and weights |

| Value-Complexity Matrix | Visual portfolio balancing focusing on quick wins vs. strategic bets | Plots initiatives on 2x2 grid (value vs. complexity); identifies low-complexity/high-value opportunities and high-risk/high-return investments | Low; intuitive for executive workshops |

| Cost of Delay (WSJF) | Time-sensitive initiatives where delay creates quantifiable business impact | Calculates urgency based on financial opportunity cost; prioritizes initiatives with highest cost of delay relative to implementation duration | High; requires robust financial modeling |

| Portfolio Kanban with WIP Limits | Agile/lean environments emphasizing flow and continuous prioritization | Visualizes all initiatives in workflow stages; limits work-in-progress to prevent overcommitment; promotes pull-based portfolio management | Moderate; requires cultural shift to limit concurrent work |

| Strategic Bucket Allocation | Organizations with defined strategic themes requiring investment balance | Pre-allocates resources to strategic categories (e.g., 40% growth, 30% innovation, 20% operational excellence, 10% compliance); prioritizes within buckets | Moderate; requires clear strategic theme definition |

The prioritization process must address three fundamental questions sequentially: (1) Strategic Alignment: Does this initiative advance our top strategic priorities, or is it a "nice to have" that dilutes focus? (2) Value Creation: What measurable business outcomes will this deliver, and when will they materialize? (3) Feasibility: Do we have the capabilities, capacity, and risk tolerance to execute successfully?

Many organizations falter by attempting to prioritize without clarity on strategic themes. When asked to rank 150 projects without strategic context, stakeholders default to political negotiation rather than value-based decisions. Leading organizations invest in executive alignment workshops where the C-suite defines 3-5 strategic themes with clear investment guardrails. For example: "Digital Customer Experience (30-40% of portfolio capacity): Initiatives that measurably improve customer satisfaction, reduce friction, or enable self-service capabilities. Must demonstrate positive NPV within 24 months."

The prioritization discipline extends beyond the initial ranking—it requires dynamic rebalancing as conditions change. Organizations with adaptive portfolio management conduct quarterly reviews assessing whether current prioritization reflects latest market intelligence, resource realities, and strategic pivots. This agility prevents the common trap where annual planning locks in decisions that become obsolete within months.

Resource constraints introduce an essential forcing function: executives must explicitly choose between good opportunities rather than attempting to pursue everything. This "capacity-constrained prioritization" reveals strategic clarity—or its absence. Organizations demonstrating maturity maintain a "ready pipeline" of approved but unfunded initiatives that can be activated quickly when capacity becomes available through project completion, cancellation, or resource acquisition.

Practical Implementation Approach:

Begin prioritization with scenario modeling: "If we could only fund 60% of proposed initiatives, which would we select?" This constraint forces honest evaluation rather than allowing every initiative to be deemed "critical." Conduct prioritization workshops with cross-functional leaders using structured frameworks to minimize bias. Make priority rankings visible across the organization, reinforcing accountability for strategic alignment. Establish clear governance for escalating priority conflicts that cannot be resolved through framework application—some decisions require executive judgment beyond analytical scoring.

Importantly, prioritization includes the courage to kill underperforming initiatives. Organizations clinging to struggling projects out of sunk cost fallacy or political considerations drain resources from higher-value opportunities. Leading portfolio managers institutionalize quarterly "portfolio pruning" sessions examining whether in-flight projects still warrant continuation based on current strategic relevance and performance trajectory.

The prioritization framework should also account for portfolio balance across dimensions beyond strategic themes: risk profile (avoiding excessive concentration in high-risk initiatives), time horizon (maintaining mix of quick wins and long-term bets), innovation vs. optimization (balancing transformational and incremental improvements), and business unit allocation (ensuring enterprise optimization rather than political division of resources).

Explore how Planisware's portfolio management capabilities enable scenario planning, investment prioritization, and dynamic funding models that adapt as strategic priorities evolve, or discover AI-powered portfolio optimization approaches that accelerate value realization through intelligent prioritization.

Implementing Strategic Portfolio Management represents a significant organizational transformation requiring 18-36 months to achieve maturity, depending on enterprise maturity, existing portfolio management practices, and executive commitment. Organizations that approach SPM as a multi-year journey—rather than a software deployment—consistently achieve superior outcomes and sustained adoption.

Phased Implementation Roadmap:

Successful SPM implementations follow a deliberate progression through four distinct phases:

Phase 1: Foundation Building (Months 0-6)

Establish executive sponsorship and governance structure with clearly defined roles—executive steering committee (sets strategic direction), portfolio management office (operational execution), and functional champions (business unit adoption advocates). The executive sponsor commitment is the single most critical success factor; implementations lacking active C-suite engagement consistently underperform or stall.

Conduct comprehensive portfolio inventory documenting all active and planned initiatives, resource allocations, budgets, timelines, and strategic rationale. This baseline assessment typically reveals sobering realities: 30-50% more projects than capacity supports, fragmented data across multiple systems, and limited visibility into portfolio health. Organizations should resist the temptation to skip this inventory—accurate baseline data enables measuring SPM's value realization.

Define strategic themes and investment criteria through executive workshops where leadership articulates the 3-5 strategic priorities that should guide all portfolio decisions. Translate abstract vision statements into concrete investment guardrails: "Customer Experience (35% of capacity): Initiatives improving NPS by 10+ points or reducing customer effort by 25%+ within 18 months."

Select and configure SPM technology platform aligned with organizational requirements—considering integration with existing project management, financial, and HR systems. The global PPM market, valued at $6.13 billion in 2024 and growing at 13% CAGR, offers diverse solutions ranging from enterprise suites to specialized portfolio optimization tools. Platform selection should prioritize strategic alignment support, scenario planning capabilities, real-time analytics, and user experience that encourages adoption over feature breadth that remains unused.

Phase 2: Pilot and Prove (Months 6-12)

Launch SPM practices with one high-profile portfolio as proof-of-concept, typically selecting a business unit with executive sponsorship, reasonable portfolio maturity, and willingness to experiment with new processes. This "pilot with impact" approach delivers quick wins that build momentum while containing implementation risk.

Implement demand management process establishing single intake portal, evaluation criteria, and governance cadence for the pilot portfolio. Organizations typically discover that 25-40% of submitted requests do not warrant project-level investment—they represent operational improvements handled through existing processes, ideas requiring further refinement, or initiatives misaligned with strategic priorities.

Establish measurement framework capturing baseline and ongoing performance across strategic alignment, portfolio execution, resource optimization, and decision quality metrics. Define success criteria for pilot phase—realistic targets might include 15% improvement in on-time delivery, 20% reduction in portfolio churn, and measurable increase in stakeholder confidence in portfolio data integrity.

Conduct executive portfolio reviews (monthly initially, quarterly once established) where leadership examines portfolio health, makes prioritization decisions, and addresses resource constraints or strategic misalignment. These sessions institutionalize portfolio discipline and signal that SPM is a core management practice rather than PMO administrative overhead.

Phase 3: Enterprise Expansion (Months 12-24)

Scale SPM practices across remaining portfolios using lessons learned from pilot, adapting processes to accommodate different business unit contexts while maintaining consistent strategic framework and governance. Organizations with multiple portfolios should sequence rollout based on strategic importance and change readiness rather than attempting simultaneous enterprise-wide deployment.

Integrate portfolio management with strategic planning and budgeting cycles, ensuring portfolio composition directly reflects strategic resource allocation decisions. This integration prevents disconnects where strategy documents espouse priorities that portfolio reality contradicts—for example, declaring "innovation is critical" while allocating only 10% of portfolio capacity to new product development.

Enhance analytical capabilities with scenario planning, portfolio optimization algorithms, and predictive analytics identifying risks and opportunities. Organizations at this maturity level leverage SPM platforms to answer questions: "If we acquire Company X, how does that impact our portfolio capacity and strategic balance?" or "What portfolio composition maximizes probability of achieving our 3-year revenue targets?"

Develop portfolio management competency through training programs, communities of practice, and career development paths that position portfolio management as a valued organizational capability rather than administrative function.

Phase 4: Optimization and Innovation (Months 24+)

Embed SPM as standard operating rhythm with continuous improvement based on performance data and stakeholder feedback. Mature organizations conduct annual portfolio management maturity assessments identifying opportunities to enhance processes, tools, and capabilities.

Explore advanced capabilities including AI-powered portfolio optimization, automated risk detection, benefits realization tracking extending beyond project closure, and integration with outcome measurement systems linking portfolio investments to business KPIs.

Critical Success Factors:

Start with strategy, not software—technology amplifies processes, so implementing tools atop unclear strategy or dysfunctional governance produces disappointing results. Invest in change management and communication, as SPM requires behavioral changes from executives (enforcing prioritization discipline), middle managers (accepting portfolio transparency), and project teams (adapting to governance requirements). Celebrate early wins and share success metrics broadly to build momentum and overcome inevitable resistance.

Maintain realistic expectations: full SPM maturity requires 2-3 years, though measurable benefits should emerge within 12-18 months. Organizations should plan for iterative capability building rather than comprehensive transformation in year one.

Finally, ensure dedicated resources rather than expecting SPM implementation to succeed as "extra work" for already-overloaded teams. Typical enterprise implementations require 2-4 full-time equivalents during foundation and pilot phases, scaling to 6-10 FTEs during enterprise expansion depending on organizational size and portfolio maturity.

Discover Planisware's implementation approach and support services, or learn about digital portfolio solutions that accelerate implementation through turnkey capabilities for demand management, strategic planning, and agile delivery.