Empower leaders and teams to modernize infrastructure, control costs, and ensure regulatory compliance. Overcome disconnected tools, technical debt, and slow decision-making while delivering seamless digital experiences to customers

Empower leaders and teams to modernize infrastructure, control costs, and ensure regulatory compliance. Overcome disconnected tools, technical debt, and slow decision-making while delivering seamless digital experiences to customers

Planisware leads the project portfolio management software market for banks and financial services firms. We deliver the tools they need to streamline their book of work in the face of growing complexity—such as legacy systems, redundant tools, compliance, and rising costs while fintech reshapes customer expectations. Here’s what separates us from the competition:

Planisware’s OpenAPI and built-in DevOps connectors integrate financial planning, portfolio strategy, and execution—, delivering real-time insights for faster, smarter decisions.

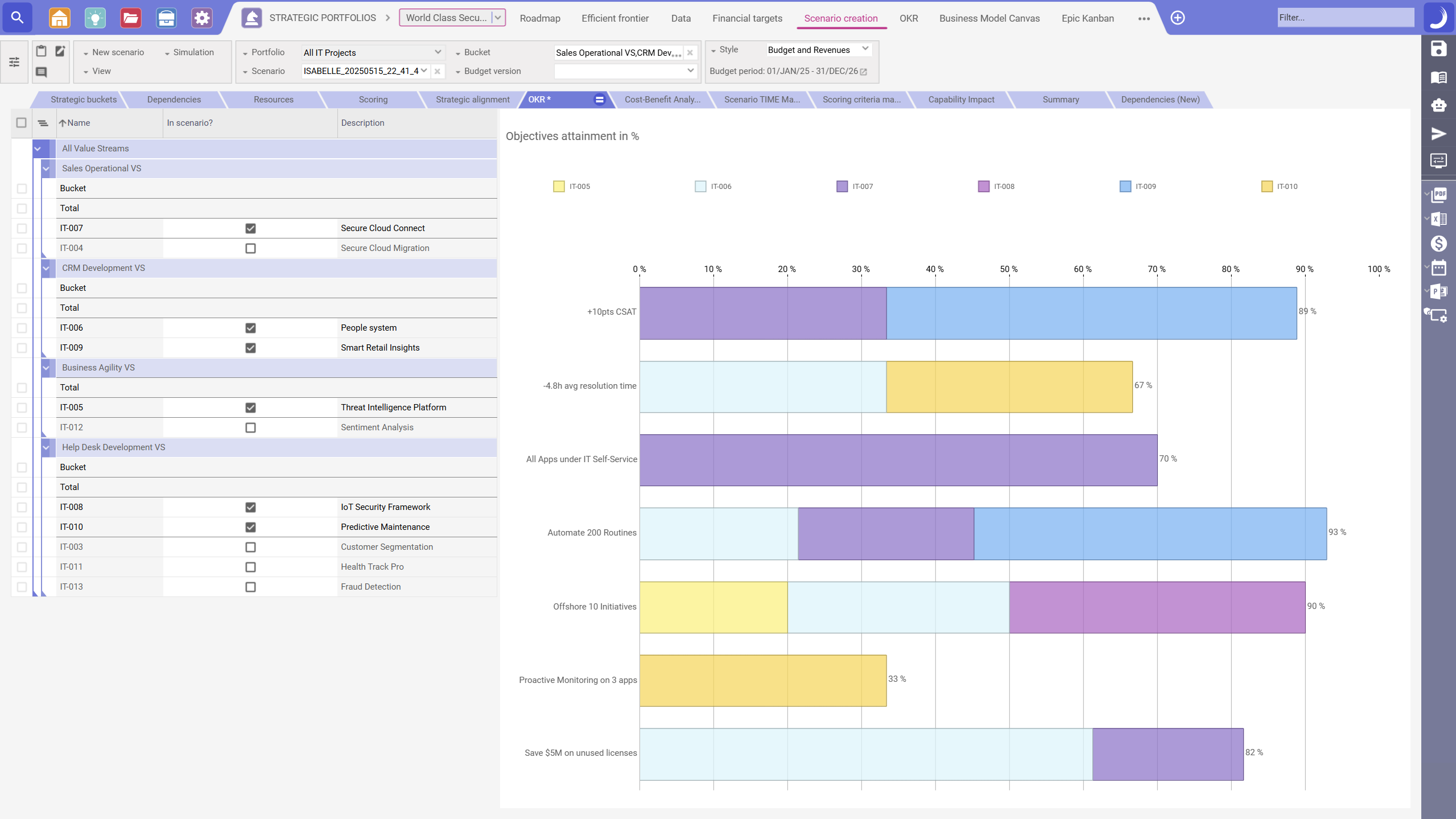

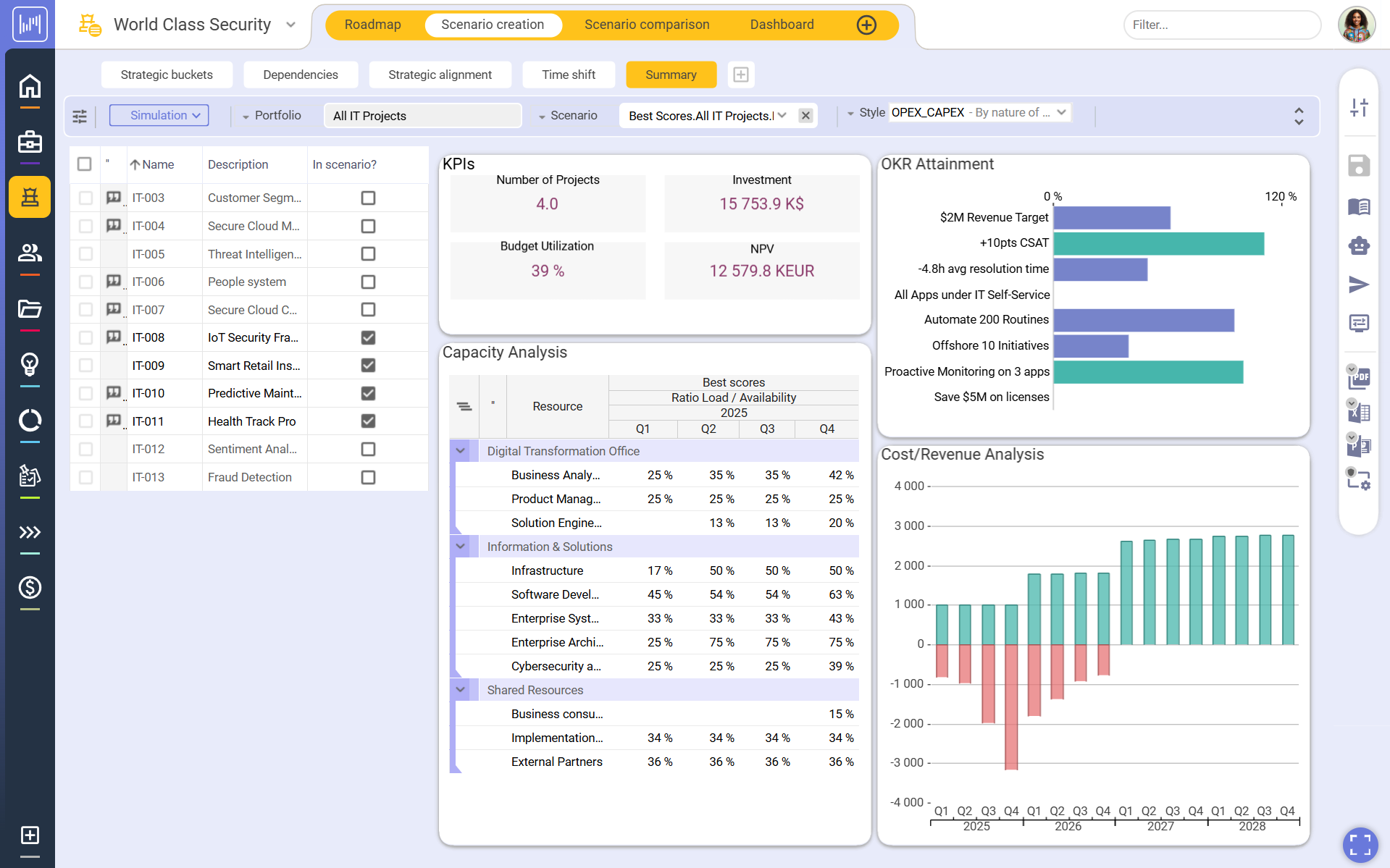

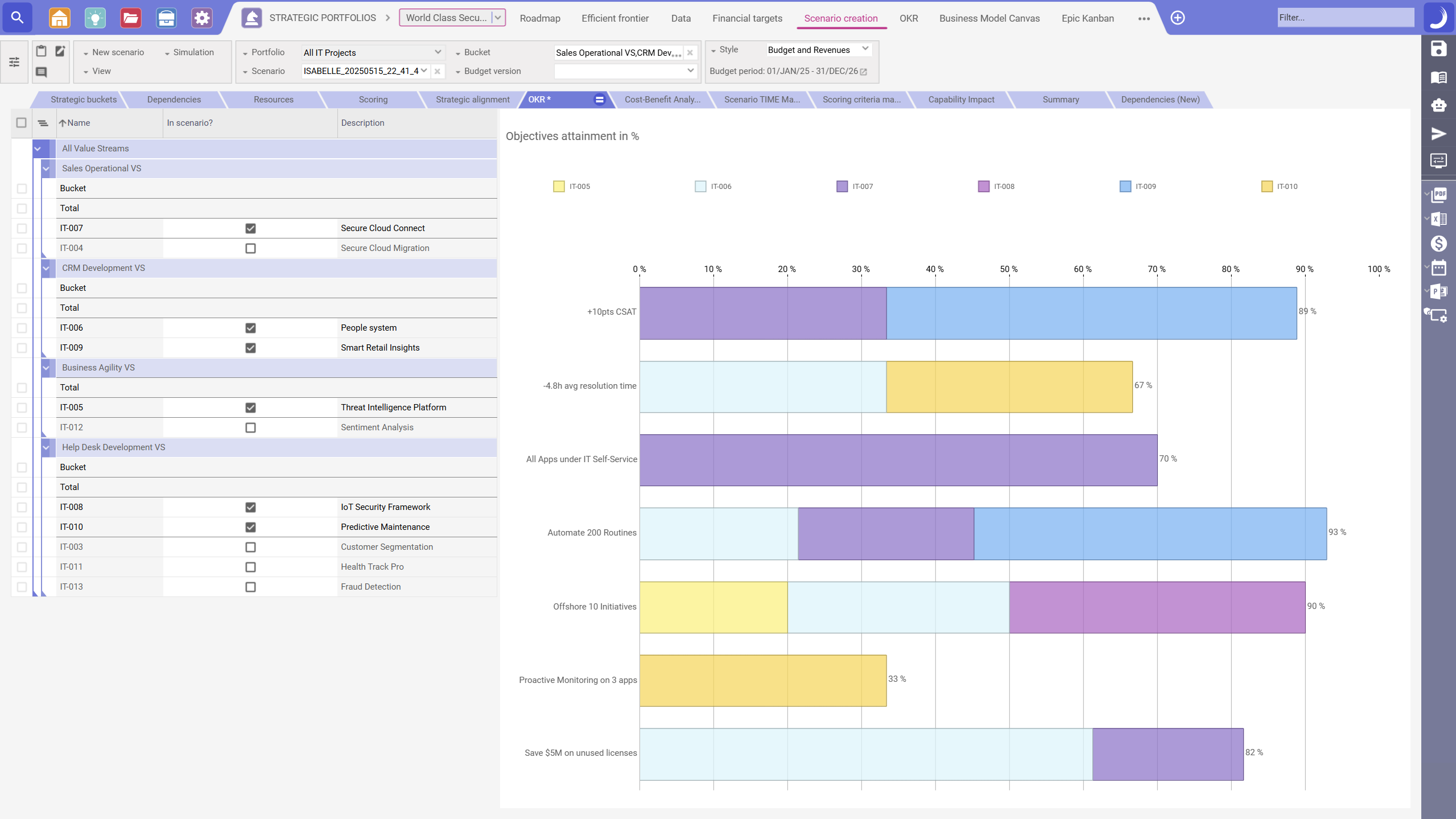

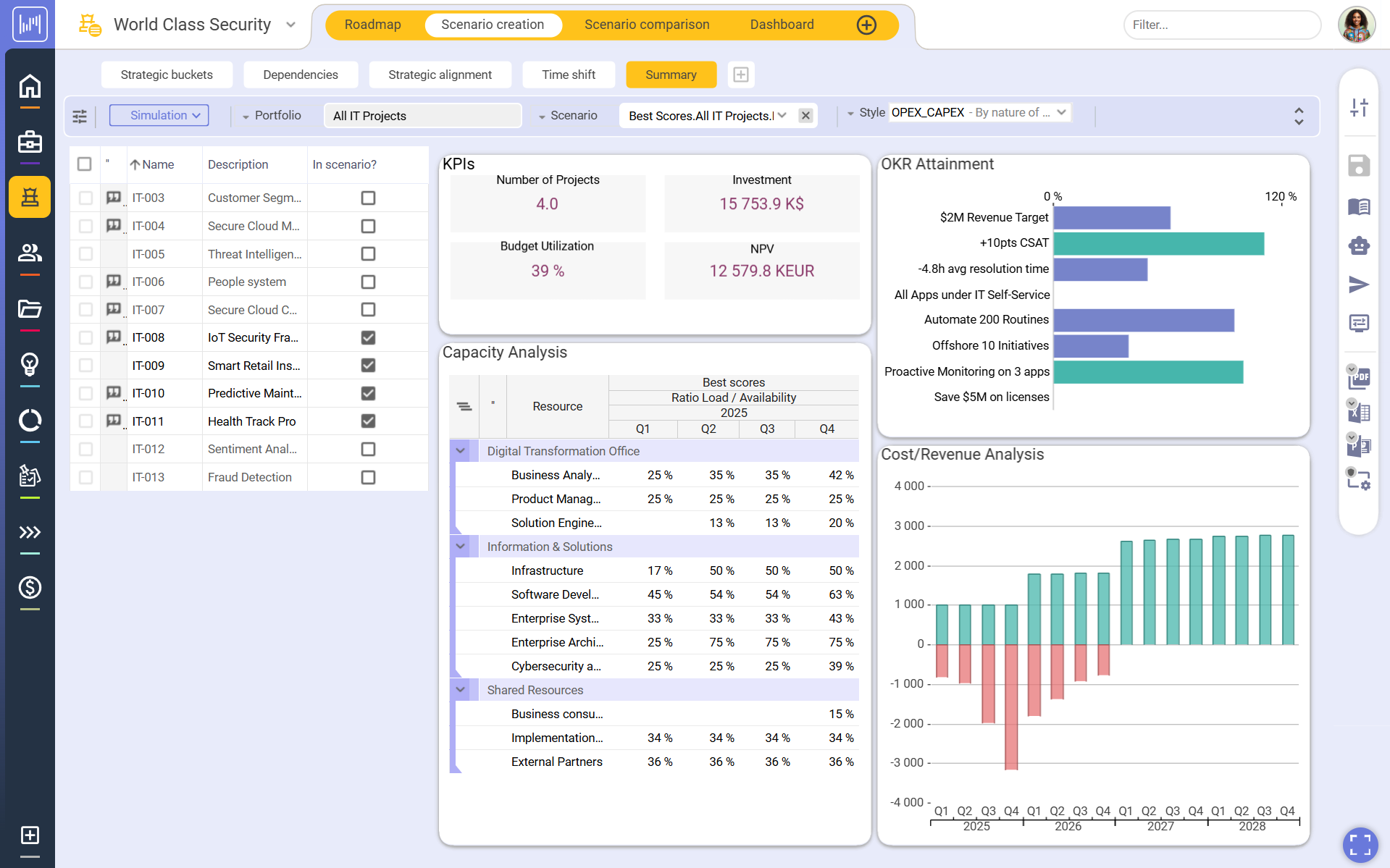

AI-powered intake identifies high-impact opportunities, while scenario planning optimizes resources and adapts investments to shifting market demands.

Managing multiple work methods in separate tools leads to silos. Planisware unifies diverse approaches, keeping teams aligned and projects on track.

Planisware automates governance workflows, tracks regulatory data, and ensures financial firms stay audit-ready as compliance mandates evolve.

Planisware is recognized as the 2024 Gartner® Customers’ Choice for Strategic Portfolio Management. With best-in-class UI, fast adoption, and responsive support, Planisware helps financial firms optimize IT investments and accelerate transformation.

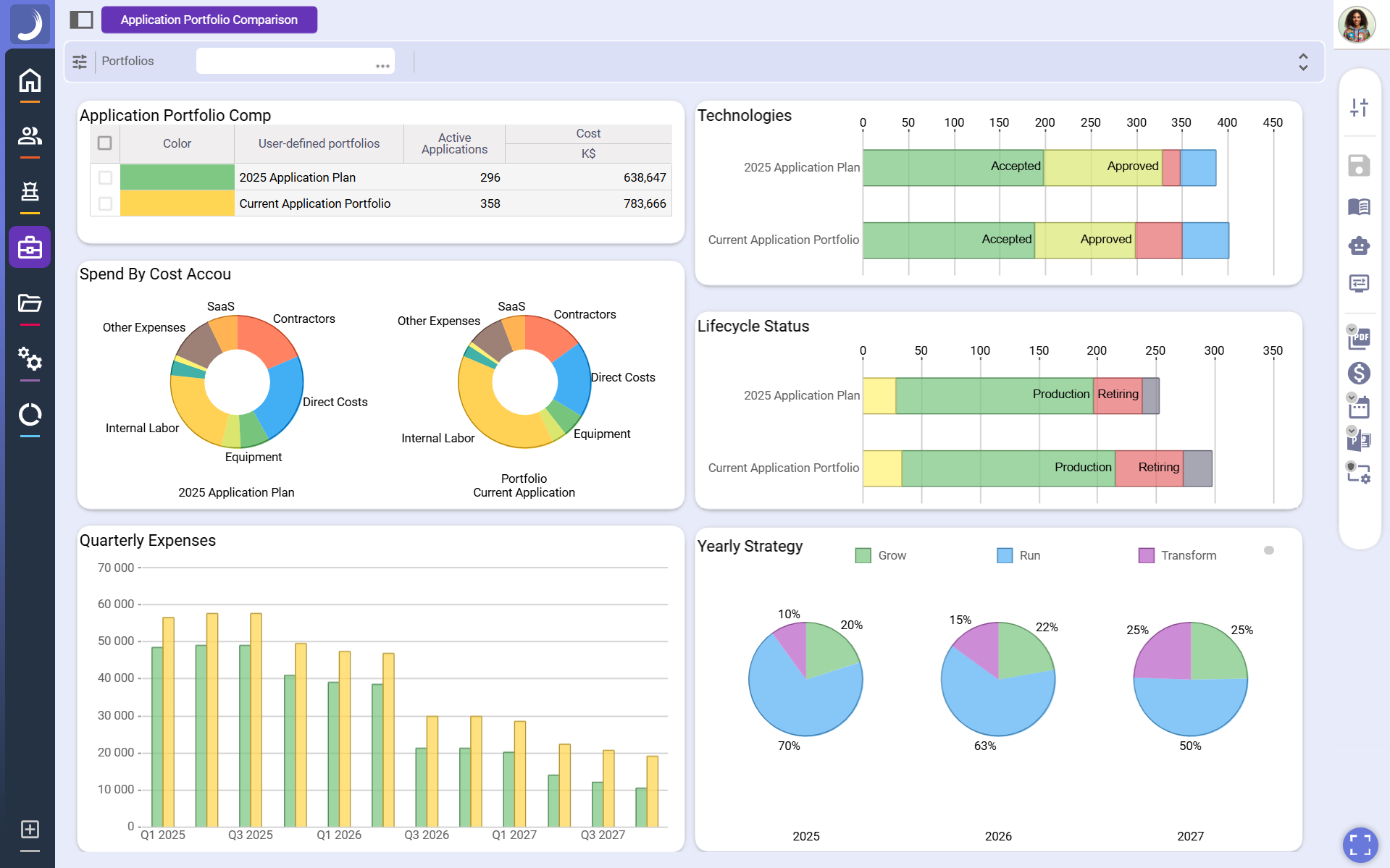

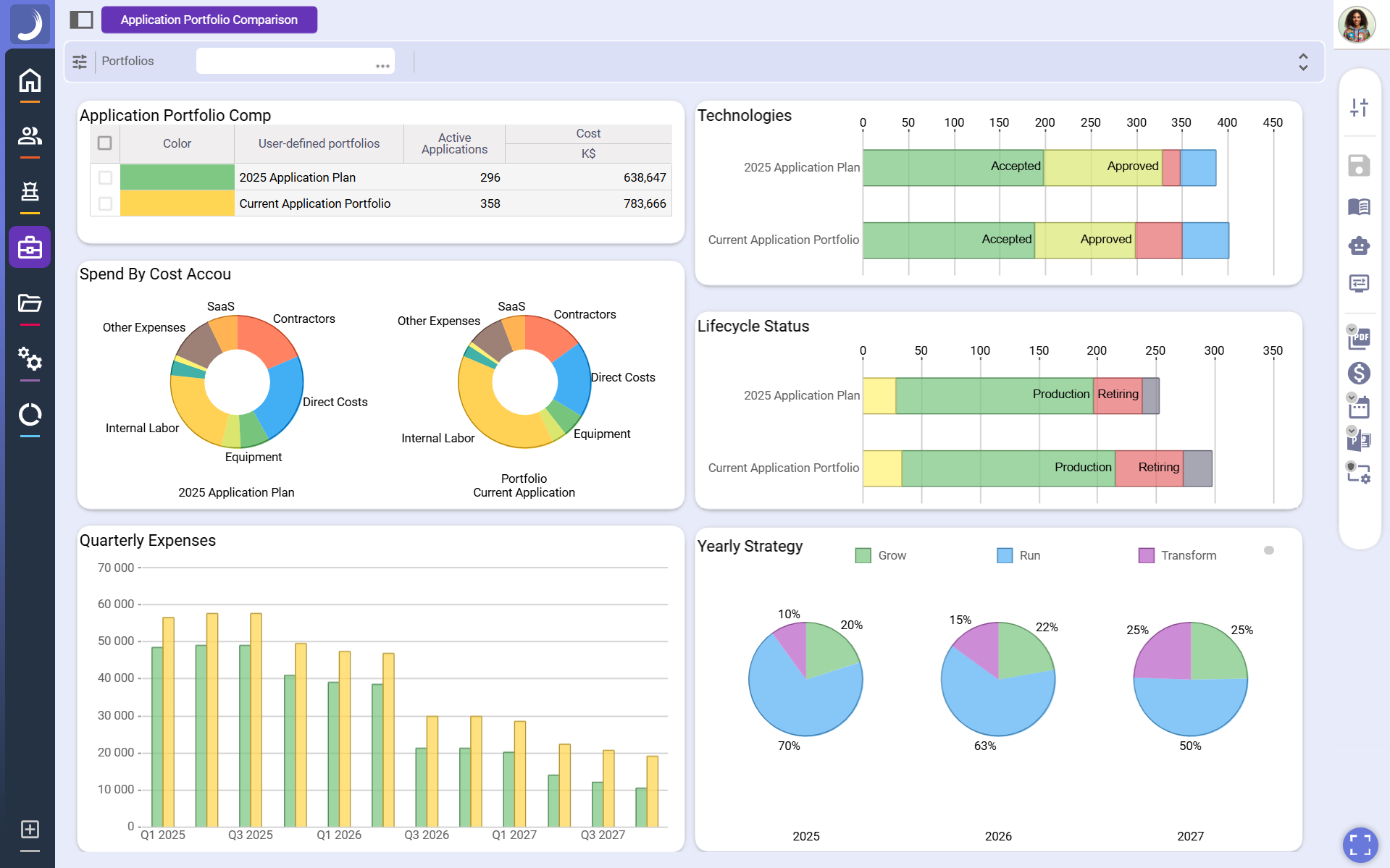

Banks and financial institutions must modernize portfolios to fuel innovation, enhance resilience, and maximize ROI—while staying agile in an evolving regulatory and economic landscape. Our solutions simplify these complexities, empowering leaders from IT to business to:

Align IT, operations, and finance with strategy by funding projects that drive measurable business impact

Dynamically allocate budgets and resources to balance innovation, operational stability, and long-term growth

Automate governance workflows, track regulatory risks, and ensure compliance-driven and strategic initiatives stay aligned, on time, and on budget

Speed up go-to-market timelines for new banking services, AI-driven financial products, and fintech partnerships with integrated portfolio management.

Forecast demand, control costs, and mitigate risk to stay ahead of disruptions and seize new opportunities

Banks, insurance providers, and investment firms stay ahead by leveraging Planisware’s project portfolio management tools to optimize IT investments, accelerate digital transformation, and ensure compliance. Our solutions empower leaders to act efficiently and effectively to drive smarter and faster innovation.