Very few companies boast the kind of resources to engage in every viable project proposal that they identify.

So, a key question of project portfolio management (PPM) is: given my limited investment budget, how do I select the projects that generate the most value for my organization?

The efficient frontier theory aims at answering that question.

What is the efficient frontier?

The efficient frontier is a concept that represents the project portfolio—that is, a selection of potential projects—offering the highest expected return for a given level of investment.

You may see it referred to as the Markowitz efficient frontier—the method was first theorized by Harry Markowitz in the 1950s. It is a foundation of modern portfolio theory, used as a framework for assembling a portfolio so that expected returns are optimized for the resources invested.

The efficient frontier, therefore, represents portfolios that maximize value for the costs they incur. As well as PPM, it can be applied to financial investment portfolios.

Visualizing the efficient frontier

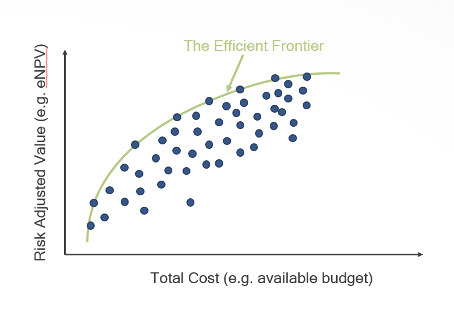

The efficient frontier is a graphical representation that assesses portfolios by comparing theoretical value (y-axis) versus cost (x-axis). It is always a curved line—as costs are increased, the increased value eventually becomes relatively smaller and returns start to diminish.

According to Markowitz, an optimal portfolio—one that comprises the efficient frontier—should be a balance between acceptable risk and return, sitting on or above the efficient frontier.

Portfolios that fall below or to the right of the efficient frontier line are “suboptimal”: that is, the value the portfolio returns is not justified by its level of investment or risk.

Each organization will have a different way of scoring value. It can be estimated using historical performance data, but it does not have to be strictly financial: the scoring model may factor in intangible benefits. Value may correspond to the strategic goals of the organization.

As such, no two efficient frontiers will be the same. It differs for each organization based on industry and the number of projects in the portfolio.

In this video, Dr Michael M. Menke, a portfolio management expert, offers his quick perspective on what the efficient frontier is in the context of portfolio management.

What are the benefits of the efficient frontier in PPM?

The efficient frontier helps project and product portfolio managers to discover the best selection of investments for maximizing portfolio value, while minimizing risk. In recent decades, it has gained favor over traditional project prioritization techniques for several reasons:

It gives comparative insights for resource allocation

The efficient frontier allows you to compare your portfolio with what is deemed “optimal.” It helps portfolio managers to identify the minimum investment required to achieve a certain return, to identify overspend, and to identify whether value is being left on the table.

After plotting your portfolio, you may discover that, for the same budget, you could generate greater returns—or you may discover the value you’re currently seeing could be achieved at a lower investment.

Ultimately, these insights can give you guidance on how to best deploy limited resources.

It offers a visual approach for decisionmaking

The graphical nature of the efficient frontier helps to create a different perspective, enabling managers and decision-makers to understand the relationship between the value created by the portfolio and the costs incurred.

By promoting informed cost-value optimization in decision-making, the efficient frontier helps everyone better understand the trade-offs involved in choices made.

It’s suitable for a range of complex business models

The efficient frontier builds the optimal portfolio before the projects are started. This makes it particularly useful for business models where projects require very large investments (especially at the beginning of the program), where the benefits will be realized several years down the road, and where projects are seldom killed.

This particularly applies to R&D teams in pharmaceutical and biotech, healthcare and medical devices, aerospace and defense, and the chemical industry.

To dive deeper on the benefits, don’t miss our webinar, The Best (Possible) Product Portfolio. In it, Dr. Richard Bayney—President & Founder of PPVC, a leading PPM consulting boutique—explains his technique for maximizing portfolio value along the efficient frontier.

Do your project portfolios measure up the efficient frontier? Planisware’s leading PPM solutions help you to maximize value for your organization. Start your journey towards a fully-optimized project portfolio—request a demo today.